unified estate and gift tax credit 2020

The fair market value of these items is used not necessarily what you paid for them or what their values were when you acquired them. The Estate Tax is a tax on your right to transfer property at your death.

2021 Year End Financial Tax Planning Efpr Group

It consists of an accounting of everything you own or have certain interests in at the date of death Refer to Form 706 PDF PDF.

. The regulations implement changes made by the. 20 2018 the IRS clarified that individuals taking advantage of the increased gift tax exclusion amount in effect from 2018 to 2025 will not be adversely impacted after 2025 when the exclusion amount is scheduled to drop to pre-2018 levels. The IRS formally made this clarification in proposed regulations released that day.

2021 Cost Of Living Adjustments And Estate Gift Tax Limits Cpa Boston Woburn Dgc

How The Unified Tax Credit Maximizes Wealth Transfer Blog Jenkins Fenstermaker Pllc

:max_bytes(150000):strip_icc()/WheretoGetaMoneyOrder-7e5ce5ccbac84b39aaa04b5aba66a961.jpg)

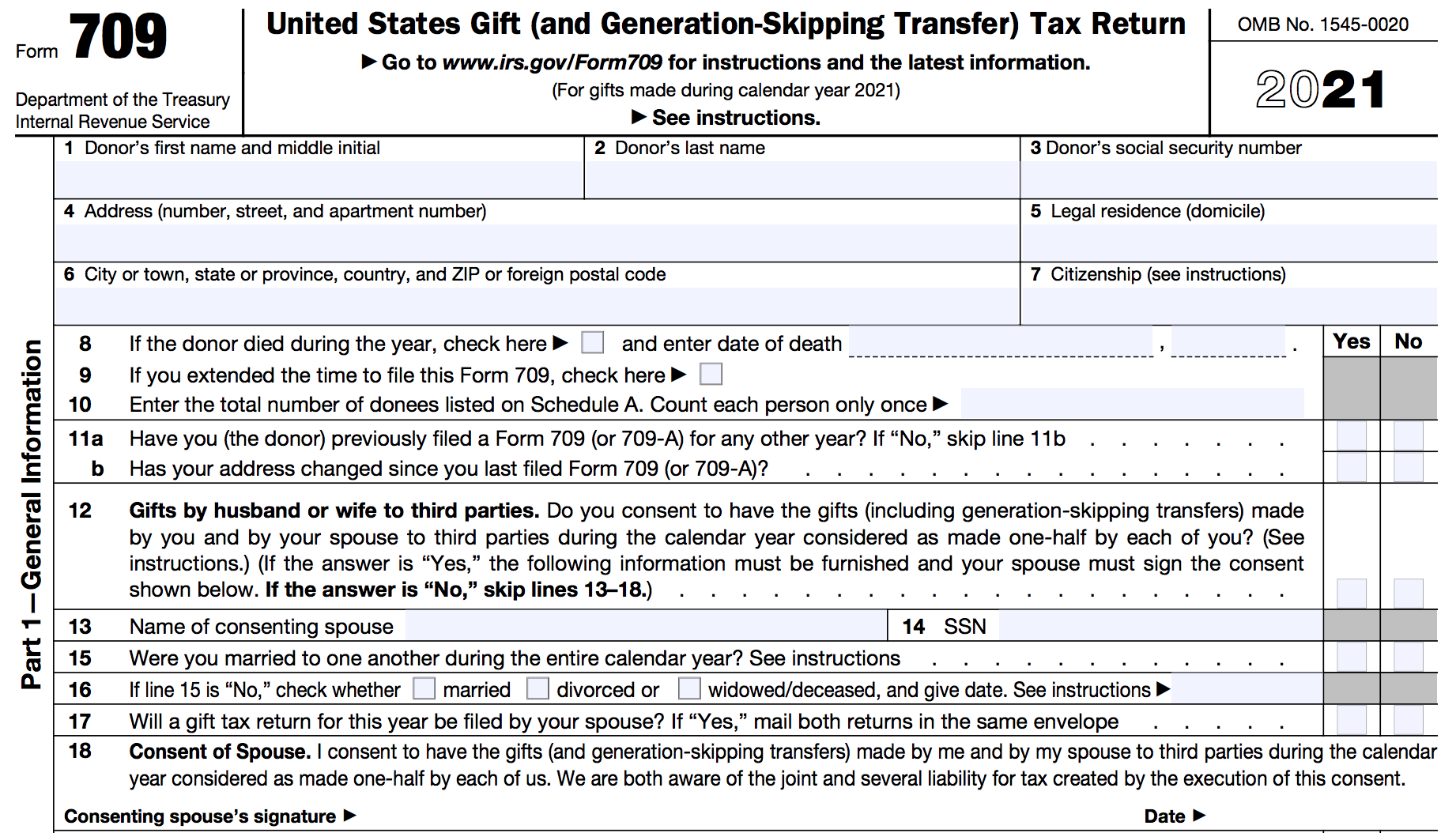

Form 709 United States Gift And Generation Skipping Transfer Tax Return

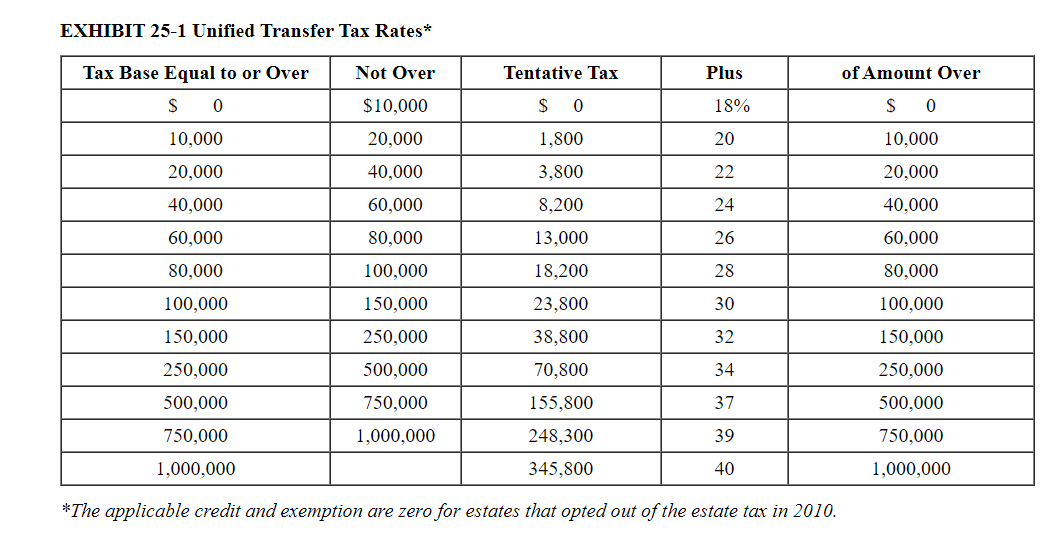

Solved Exhibit 25 1 Unified Transfer Tax Rates Not Over Chegg Com

Gift Tax Unified Tax Credit Estate Tax Corporate Income Tax Course Cpa Exam Far Youtube

Personal Planning Strategies Lexology

Solved Gabriel Had A Taxable Estate Of 8 4 Million When He Chegg Com

Understanding Qualified Domestic Trusts And Portability

Tax Related Estate Planning Lee Kiefer Park

Tackling Tax Issues If You Re An Estate Executor Ferrari Ottoboni Caputo Wunderling Llp

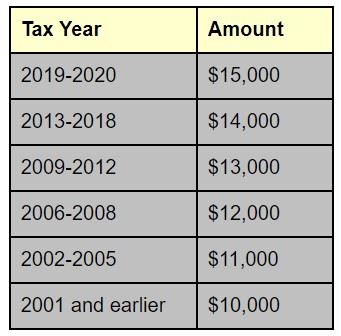

History Of The Unified Tax Credit Apple Growth Partners

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

A Look At 2020 Cost Of Living Adjustments And Estate Gift Tax Limits Cpa Boston Woburn Dgc

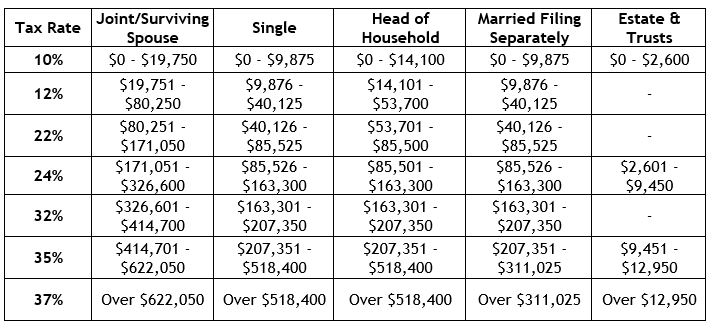

2020 Year End Tax Planning Highlights For Individuals Dalby Wendland Co P C

How To Fill Out Form 709 Step By Step Guide To Report Gift Tax Smartasset

A Look At 2020 Cost Of Living Adjustments And Estate Gift Tax Limits Cpa Boston Woburn Dgc